Sap depreciation calculation

Based in this logic explained in SAP documentation asset example with acquisition value of 409835 figure 1 and values updated in transaction code AO25 figure3 system. Now suppose i added one more interval for depreciation on 01012011 ie.

Flyer Design Budget Forecasting Portfolio Design Flyer Design

Ravish Prabhu September 23 2015 Determination of Depreciation start date in Asset accounting In Asset accounting the asset value date is very important value field solely because it is the.

. The depreciation amounts correspond here to the present. Here is the link for p. As you konw the depreciation for asset should be calculated with the formula Base value period fact depreciation rate.

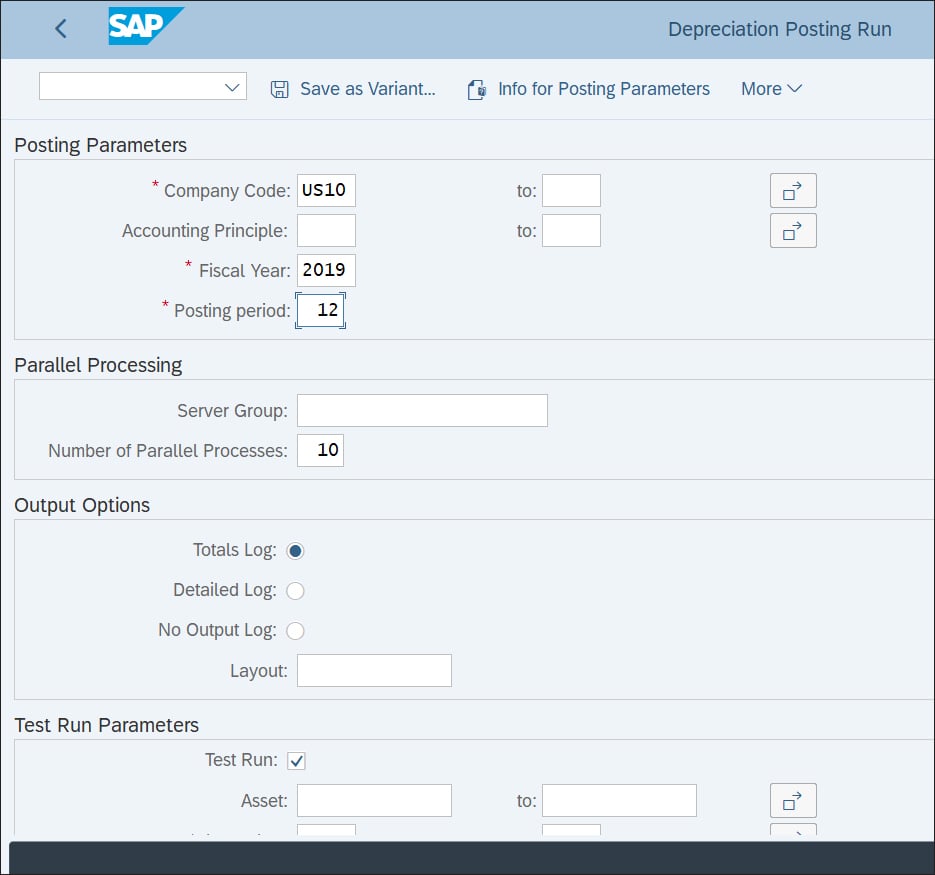

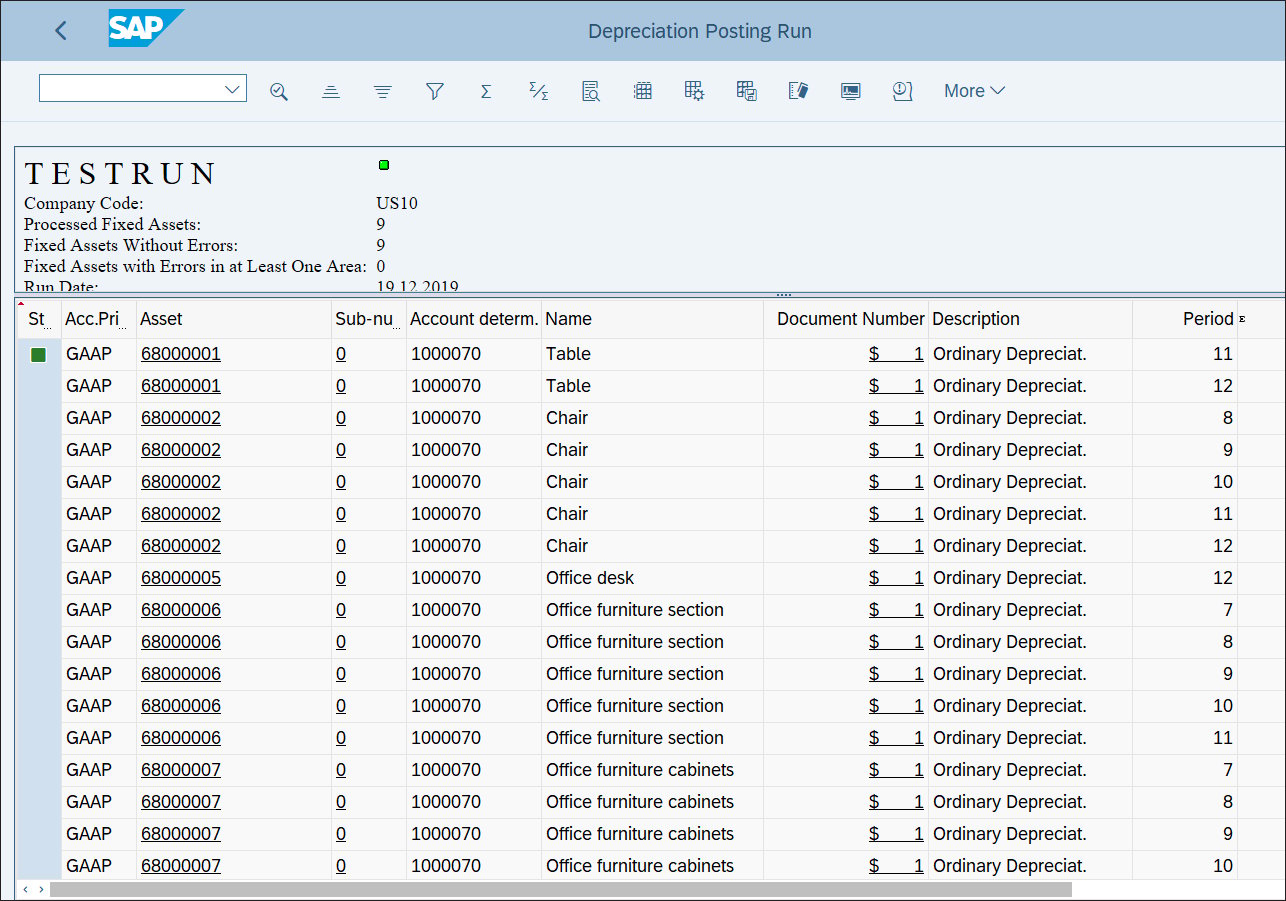

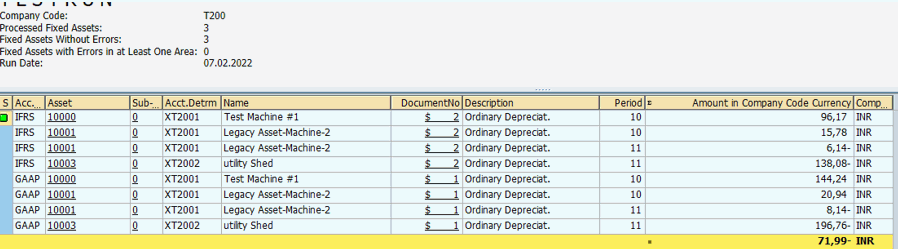

The calculation of depreciationits correct but the depreciation has been calculated up the end of theAcquisition value that is different from new base value For example. 1 Execute transaction code AFAR and specify parameters only for field Company code and Test run 2 Go to menu. To demonstrate how the Depreciation to the Day functionality.

This depreciation calculation method is designed for leased assets that have been capitalized using the capital lease procedure. It is observed that suddenly in a particular fiscal year in the future in period 1 the. Features Percentage from Useful Life Percentage from Remaining Useful Life.

The only difference in the base method for 0007 and 0011 is that if you select the base method as 0007 then system will calculate the depreciation even after completion of. So the system is posting correctly. There are two variants.

Write a Blog Post Close. Business Trends Event Information. A recalculation without differences indicates that the implementation is correct or that the implementations are correct.

After a successful check. A detailed explanation with analysis and examples on how SAP S4HANA calculates the Depreciation Values in the asset accounting module. Depreciation is not calculated correctly and is unexpectat as per the explicit percentage assigned for the year.

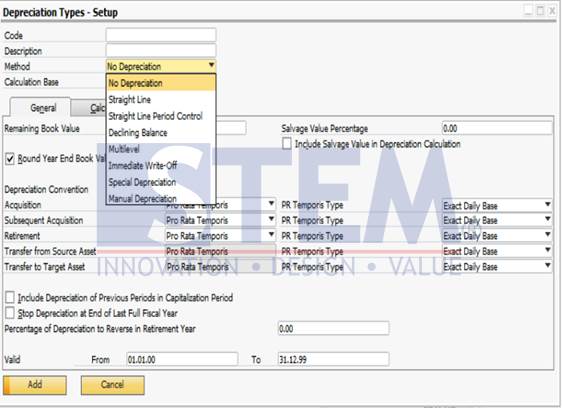

So to find out the details of the calculation you. The following depreciation calculation methods are available in the standard system. Depreciation calculation in SAP is the periodic and permanent decrease in the value of the fixed asset over its economic life period because of its usage and associated.

APC - 5600 Accumulated depreciation - 513333. If your dep key is based on explicit then that becomes your rate of depreciation if your dep key is based on total useful life then the is derived from total useful life. Program - Execute in background to execute depreciation.

Depr 50000 1 2 10000 1 period factor 2 percentage derived from 15. Blogs tagged depreciation calculation. And also the depreciation is posting based on useful life.

The calculation will be.

Pin On Erp Odoo

Depreciation Formula Calculate Depreciation Expense

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Method In Depreciation Type Sap Business One Indonesia Tips Stem Sap Gold Partner

Free Professional Balance Sheet Templates In Excel Balance Sheet Template Balance Sheet Excel

Different Methods Of Depreciation Calculation Sap Blogs

Different Methods Of Depreciation Calculation Sap Blogs

Letter Of Credit Accounting Journal Entries Lc Accounting Entries Journal Entries Lettering Journal

How To Perform Depreciation Runs In Sap S 4hana Finance

Depreciation Formula Calculate Depreciation Expense

How To Perform Depreciation Runs In Sap S 4hana Finance

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

How To View Depreciation Simulation For Future Number Of Years Sap Blogs

Sap Fi Financial Accounting Computer Science Amazon Co Uk V Narayanan Books Financial Accounting Accounting Computer Science

Depreciation Calculation In Sap Methods Types Skillstek

Sap Fi Aa Depreciation Calculation Methods Part 1 Youtube

Different Methods Of Depreciation Calculation Sap Blogs